Key Takeaways

- In the modern eCommerce landscape, convenience is the ultimate growth lever: when the path to purchase is effortless, sales become inevitable. This guide, based on a survey of 6,000 global consumers, identifies four pillars of “easy”: payment freedom (1 in 5 abandon carts if their preferred method is missing), subscription control (allowing users to pause or skip without drama), marketplace presence for discovery, and omnichannel flow (like BOPIS/BORIS).

- By localizing these features to match regional habits—such as mobile-first wins in the US or “picky paying” in the UK—enterprise retailers can eliminate friction points that turn “buy” into “bye.” Ultimately, providing convenience isn’t just about speed; it’s about granting shoppers the choice and continuity they need to trust your brand at every touchpoint.

When shopper convenience increases, so does conversion. Our global shopper survey of 6,000 consumers in the US, UK, Germany, France, and the Netherlands shows that buyers reward the easiest path to purchase.

Learn what convenience looks like now, how expectations differ by market, and where to adjust your strategy to make customer convenience your most reliable growth lever.

Why Customer Convenience Matters (And Pays)

Shoppers compare you to their last great experience. Half of global consumers are moving fluidly across channels and expect the same seamless journey at every touchpoint. If your customer journey has speed bumps – think surprise fees, missing payment options, clunky returns – consumer purchase behavior flips from “buy” to “bye”.

And customer convenience isn’t just about price: It’s about control, choice, and continuity. Shoppers expect payment freedom, subscriptions they can manage on their terms, marketplace breadth for fast discovery, and a touch of omnichannel magic that lets them kick off in one channel and wrap up in another, without missing a beat.

Want the full low-down on convenience trends by market? Get Inside shoppers’ Mindset: How Global Brands Can Meet Local Expectations and benchmark where your experience helps – or hurts – conversions.

What Customer Convenience Looks Like in 2025

Here’s how today’s shoppers define “easy”, where enterprise retailers needs to keep up, and where your eCom tech can quietly do the heavy lifting:

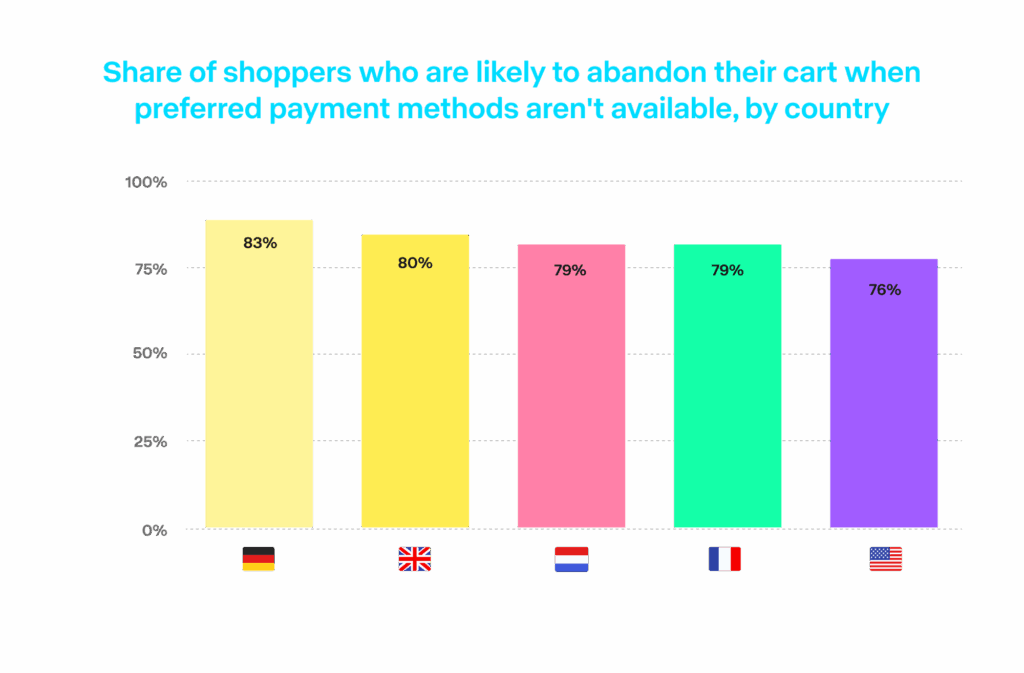

1. Freedom to pay your way

One in five shoppers says they abandoned a brand over the past year because their preferred payment method wasn’t available. This pain point spikes in Germany and the UK – two markets where “let me pay my way” is non‑negotiable.

TIP: Localize methods and make wallets obvious, fast, and default. Support local favorites and mobile wallets, so every shopper can pay their way without friction.

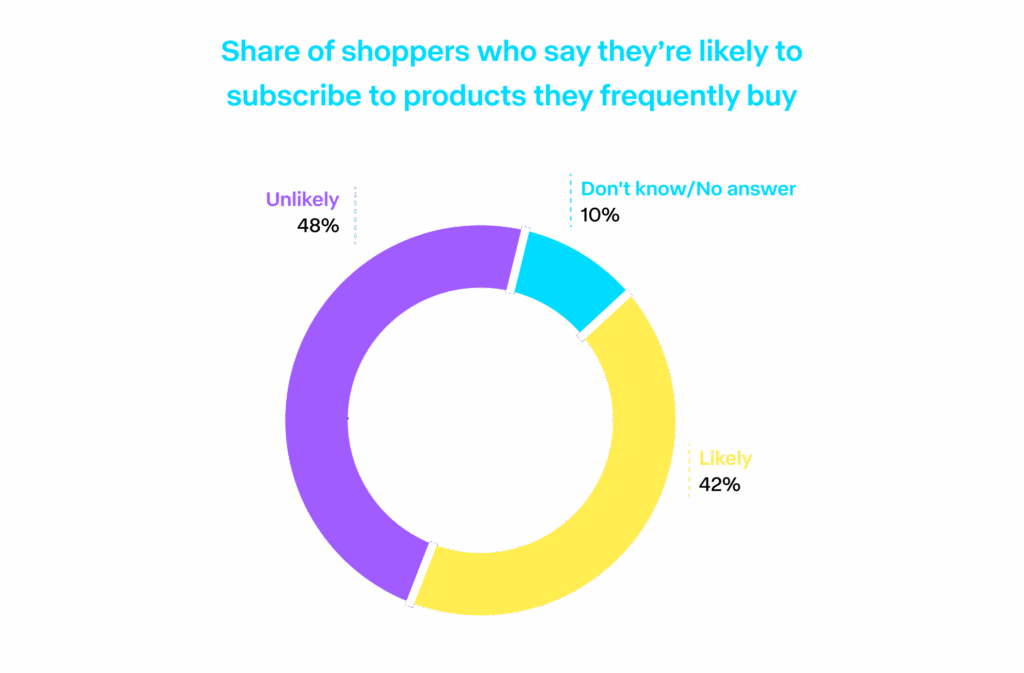

2. Subscriptions that feel like control

Global appetite is selective. Americans are the most likely to opt in – but only when they can pause, skip, swap, or cancel without drama. Meanwhile, only one in three Dutch shoppers would subscribe to frequently purchased goods.

TIP: Treat subscription UX as convenience infrastructure, not a pricing trick. Build systems that let customers pause, swap, or opt out easily, because control equals convenience.

3. Marketplaces as the front door

91% of shoppers already use marketplaces – because they’re convenient: one search, one account, trusted fulfillment. Nearly 1 in 3 will hop to the brand site to check the price, and in the US, 38% browse marketplaces without a product in mind – prime time to win discovery.

TIP: Build marketplace discipline and treat the click‑through as your loyalty moment. Keep product data clean and delivery promises reliable, so you earn trust where shoppers start.

4. Omnichannel flow

Every surveyed country rated BOPIS/BORIS among the most valued features – because they collapse time and friction. Also, 21% say synced carts matter; losing a basket between devices is an avoidable deal‑breaker.

TIP: Make “start here, finish anywhere” the default. Sync carts across devices and make in-store pickup or returns seamless, so shopping feels effortless.

Same Theme, Different Flavors: How Customer Convenience Varies by Market

Customer convenience is universal, but individual consumer buying behavior is local. The triggers for “checkout now” shift with local payment habits, delivery options, and trust cues.

-

In the US, shoppers are especially mobile‑first and subscription‑open – if the controls are generous. On marketplaces, many Americans browse without intent, then test you on price when they click through.

TIP: Shape product pages and checkout for decisive small‑screen wins. -

Shoppers in the UK and Germany are “picky payers.” If local methods aren’t visible and trusted, fast exits will follow.

TIP: Invest in local acquirers, one‑tap wallets, and clear refund timing to close the intent gap. -

France’s strong preference for in-store shopping continues to persist. Omnichannel features, however, can bridge the gap.

Think: BOPIS/BORIS and try‑before‑you‑buy.

TIP: Build hybrid journeys that make switching channels effortless. -

Dutch shoppers are likely to remain skeptical if value and flexibility is not obvious.

TIP: Test “subscribe‑without‑commitment” models with perks over penalties.

Customer Convenience Closes The Loop

Shopping convenience for customers is an operational choice. When you localize payments, design subscriptions around control, win discovery on marketplaces, and stitch channels together, you’re removing friction from the entire buying journey. If your brand wants predictable conversion lifts in 2025, start where shoppers feel it most – with fewer taps, fewer doubts, faster wins. Then keep going.

Get the full Inside Shoppers’ Mindset: How Global Brands Can Meet Local Expectations survey to see exactly where convenience converts in your markets – and what to fix first.