The US has long been fashion’s cultural engine, influencing aesthetics and global trends that define entire generations. But in 2026, the American apparel market is shifting in ways retailers can’t afford to ignore. From rising tariffs tightening margins to evolving consumer expectations, new pressures are coming from every angle.

Fashion tariffs now sit five times higher than other industries’ products. It’s time for retailers to rethink how new technology, like AI, can protect profitability.

At the same time, shoppers are forming clear opinions about AI’s role in the shopping journey. And with over a quarter of US consumers still heavily reliant on physical stores for discovery, adoption is far from guaranteed.

From our recent shopper survey across major global markets, we found that the US stands out for its cautious approach to AI. So, whether your brand sells in the US or simply follows its influence, understanding consumer sentiment around the latest trends is essential. Find out which ones are shaping US fashion and apparel retail in 2026 – and what they mean for the year ahead.

1. AI assistants rise – but autonomy falls flat

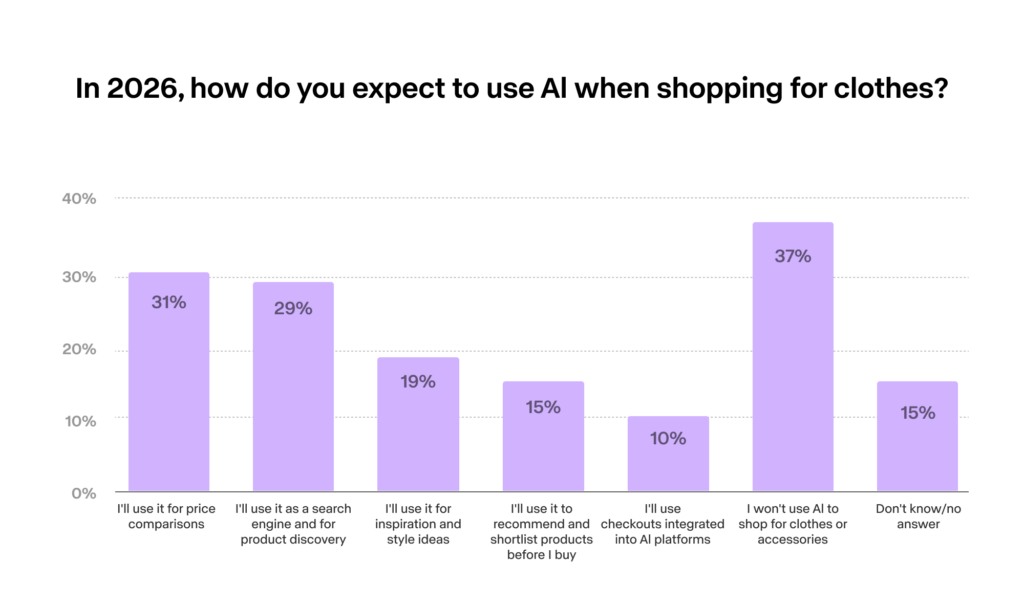

AI is shaping fashion retail globally, and American consumers are already using it to simplify their shopping journey. Around 30% of shoppers say they plan to use it for price comparisons and product discovery in 2026.

But its adoption has its limits. 36% say they don’t plan to use AI at all – one of the highest AI rejection rates worldwide. And despite the hype around agentic shopping assistants, only one in four respondents say they would trust AI to make a purchase on their behalf.

This sentiment around AI creates a uniquely cautious environment for retailers. In a market skeptical of new technology in fashion, the brands that succeed will use AI-driven features to empower shoppers by supporting them in their shopping journey.

Leverage AI behind the scenes to create clearer product descriptions, faster navigation, and more convenient discovery journeys. Because in America, your customers want AI to guide them, not shop for them – at least for now.

Looking for more AI strategies to satisfy shoppers from China to the UK? Download the 2026 guide, Fashion Retail 2026: Strategies for Winning in a World of AI, Algorithms, and Tariffs.

2. The US loves brick-and-mortar for apparel

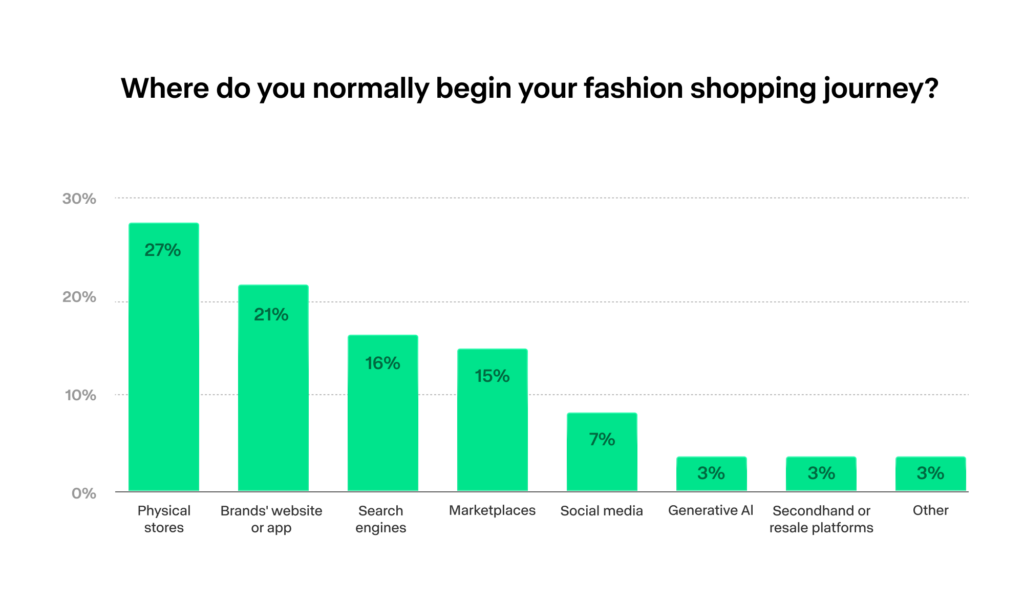

Even though apparel is the top online purchase category in the US, Americans still love starting their shopping journey in physical stores. 27% of shoppers say retail stores are where their journey begins.

And this trend rings true across all generations. Even the most digitally native shoppers, like Gen Z and Millennials, want to touch and test products in person before buying online. The brands that win will be the ones who build a discovery loop that flows naturally between storefronts and screens.

The US is a deeply omnichannel market. So for retailers, this means treating stores as more than fulfillment hubs. Use stores as discovery engines that integrate seamlessly into your online shopping experience.

Nike has already set the standard for truly frictionless omnichannel retail by integrating its app into the in-store journey. It offers services that have quickly become staples, like BOPIS (buy online, pick up in store) and try before you buy. And, while shopping in stores, Nike customers can scan barcodes with their phone to check size and color availability, instantly locate their favorited items, and use their “Member Pass” to check out.

In 2026, the brands focusing on creating customer-first experiences will be the ones winning loyalty. How can your brand create a standout omnichannel shopping journey?

3. Microtrends are reshaping search behavior

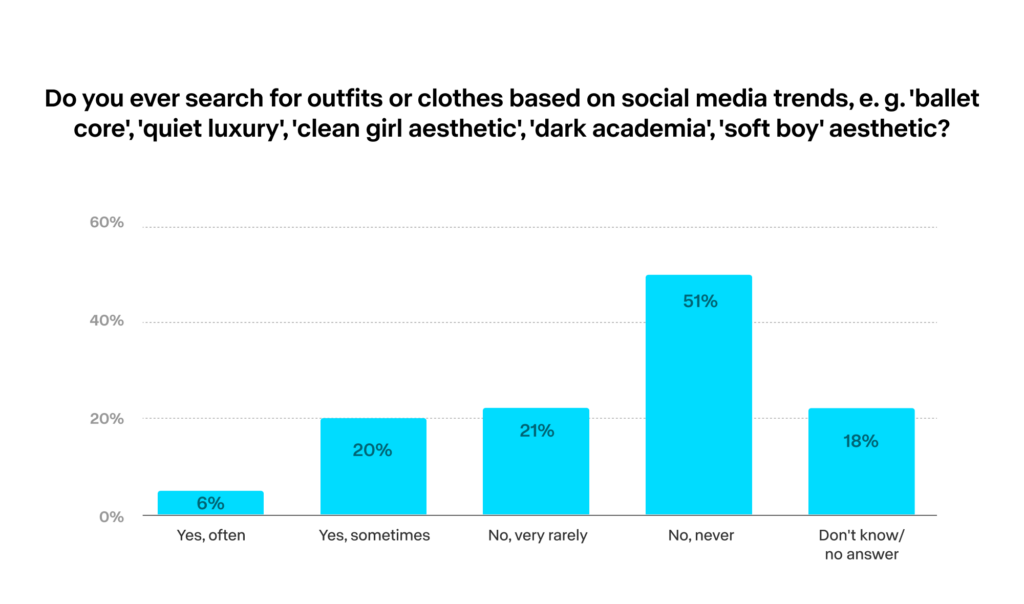

No Western market leans on aesthetic-based search terms as heavily as the US. We asked shoppers if they ever search for outfits or clothes based on social media trends, like “clean girl aesthetic,” “quiet luxury,” “old money,” etc. – and over a quarter of shoppers said they do. That’s nearly a 10% higher preference for trend-driven discovery than in European markets, where fewer than one in five shoppers do the same.

The US sits somewhere between Europe and Asia when it comes to microtrend-driven search in fashion. But in Asian countries, like China and South Korea, twice as many shoppers are leaning into this new search method.

The US isn’t just following microtrends – it’s fueling them. Cultural moments, platform-driven aesthetics, and short-lived trends are shaping how shoppers discover fashion in real time. Is your brand keeping up?

See how microtrend-led shopping is playing out globally – and what it means for enterprise fashion – download the guide, Fashion Retail 2026: Strategies for Winning in a World of AI, Algorithms, and Tariffs.

4. AR try-ons are about to take off

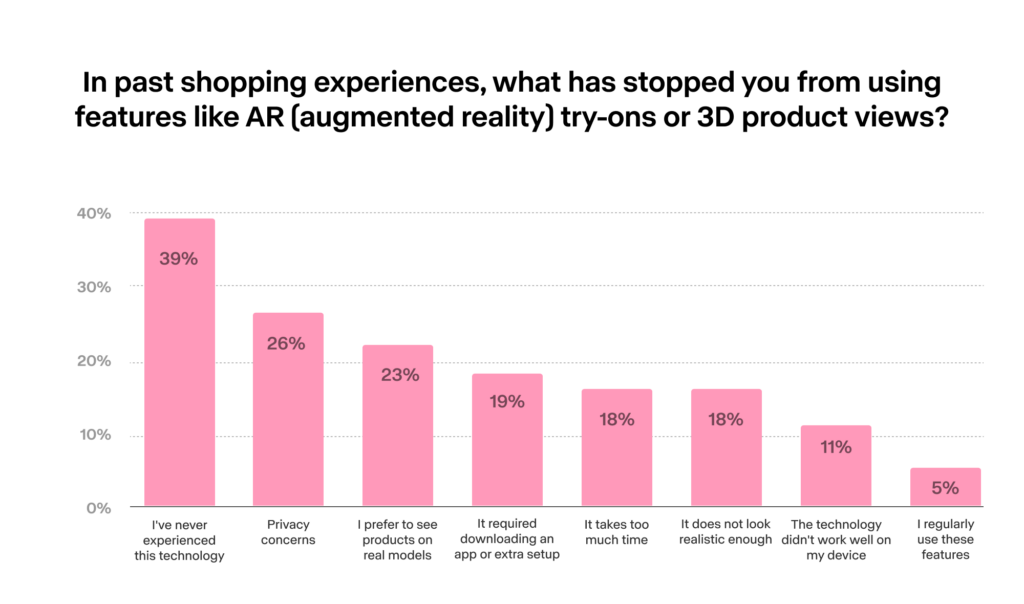

The US is one of the most AR-ready markets – but adoption is still slow. Although features like AR try-ons have been around for a while, American shoppers haven’t fully embraced them.

But slow adoption isn’t due to a lack of interest. A massive 77% of shoppers said they would be more likely to make a purchase if they could use AR to create a personalized avatar of themselves to virtually try on clothes. However, most shoppers haven’t encountered these features yet.

The biggest brands are already experimenting with this tech. Reza Shirvany, Director of Applied Science at Zalando said:

“Early pilots, currently at small experimental scale, show up to 40% fewer size-related returns, indicating that high-fidelity, data-driven AI and 3D experiences help customers make better size and fit purchase decisions online.”

So, in 2026, the brands that integrate AR are in for a win-win. You’ll significantly boost confidence, resulting in higher conversions – and lower return rates.

5. US shoppers want structured storefronts

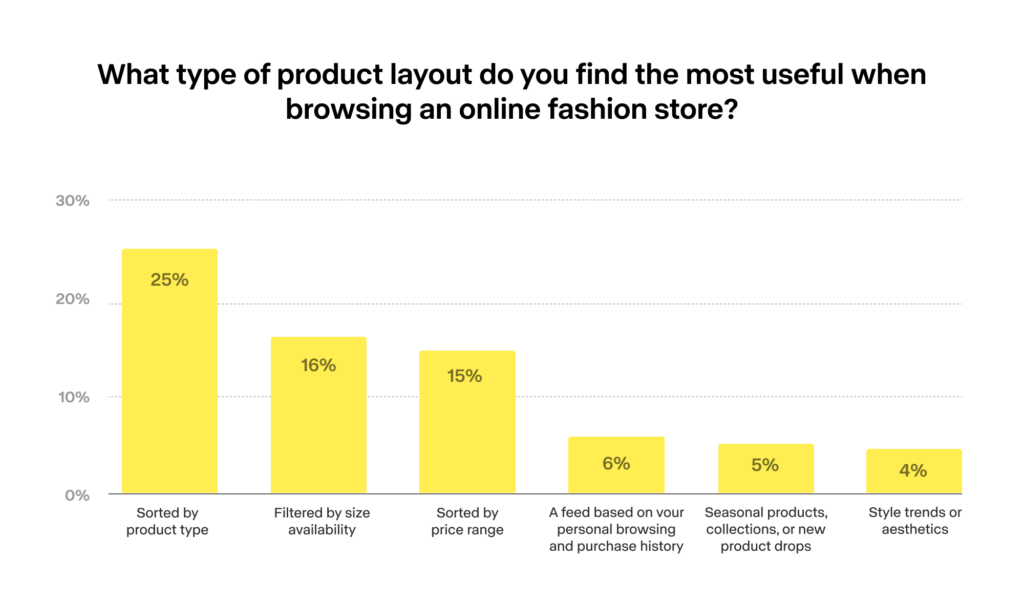

There are more options than ever when it comes to your storefront layouts. From traditional category navigation to hyper-personalized feeds, in 2026 it’s on you to figure out what your shoppers want – and deliver it.

Unlike other markets gravitating toward algorithm-driven feeds, US shoppers prefer classic, structured shopping layouts. This shows how the region values clarity and convenience in their online shopping experience.

Rather than pushing AI-curated experiences, prioritize clean categorization and intuitive navigation. Because in the US, structured storefronts deliver the confidence in brands that shoppers need to convert.

6. Emotional shopping is the heartbeat of the US market

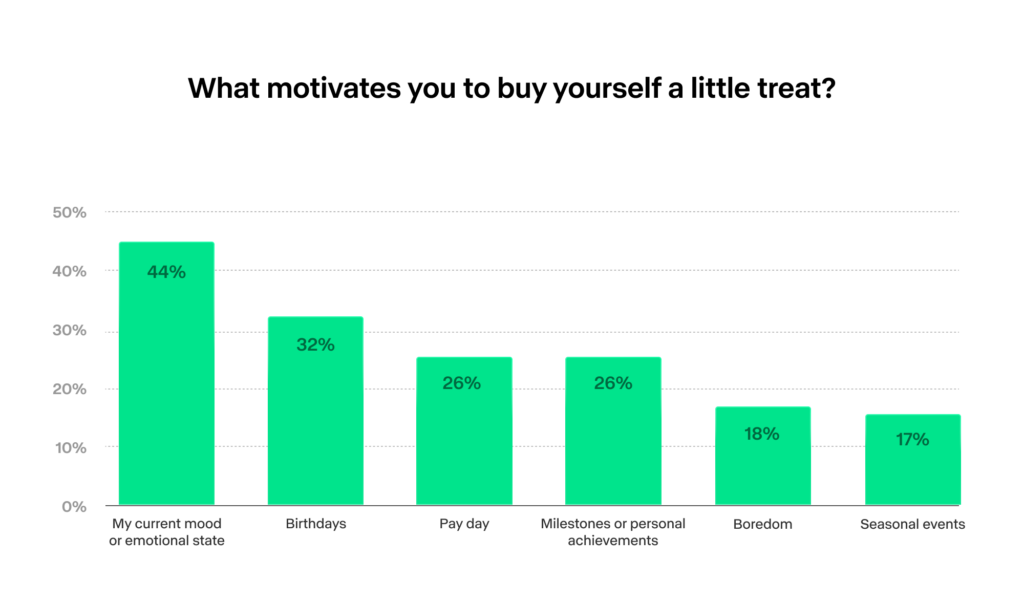

“Little treat” culture is changing how shoppers engage with brands – especially in fashion. Gen Z and Millennials face financial pressure from high living costs, debt, and delayed milestones. But despite these conditions, younger generations continue growing in influence and retail spending power. And they’re using it to buy themselves smaller, emotion-driven “treats.”

When shoppers reach for a “little treat,” nearly half (44%) say that their mood or emotional state triggers them to buy, indicating the emotional nature of shopping. The emotional purchase driver is closely followed by affordability (55%) and instant gratification (34%), showing that your customers want something they can have – now.

As a global culture engine where shoppers document everyday life on social media, the US is uniquely primed for “little treat” moments to travel fast. When a product becomes something shoppers post about, it stops being a simple transaction and quickly becomes a cultural signal.

Pop Mart’s Labubus, the collectible monster dolls used as keychains and accessories, hit every “little treat” sweet spot, from affordability to shareability. That’s what drove their viral popularity around the world.

For enterprise fashion retailers, showing up in emotional moments creates a powerful opportunity. Whether it’s through messaging, timing, or product curation, you build deeper connections and capture impulse-driven sales that feel personal – not transactional.

7. Quick commerce isn’t in fashion – yet

Q-commerce (quick commerce), is an ultra-fast delivery strategy based on grocery and food delivery models. This trend has the potential to revolutionize the apparel space – but what do American shoppers think about it?

In the US, services like Postmates, Uber Eats, and DoorDash have made near-instant delivery a normal part of daily life. But when it comes to fashion, shoppers are cautious with 30% saying they “probably” wouldn’t use it, and 20% saying “definitely” wouldn’t use it.

Compare that to Asia, where q-commerce is already mainstream. 71% of Chinese shoppers say they would use it for often or for special occasions, reflecting their familiarity with the service.

For US retailers, note that speed matters to American consumers – but in 2026, it’s not a dealbreaker. However, keep in mind that trends that succeed in Asia often make their way West. By keeping an eye on q-commerce and beginning to experiment with pilot programs now, your brand can be ready to integrate the service if ultra-fast delivery demand catches up in the US market.

Understanding the American shopper

The US market is digitally engaged and open to innovation, yet selective about how technology shows up in their lives.

Success in the region in 2026 won’t come from chasing every trend. It will come from showing your shoppers you understand them well enough to design experiences that make them feel seen.

Explore how these US fashion retail trends connect to global shifts – and how your enterprise can lead the next wave of innovation. Download the guide, Fashion Retail 2026: Strategies for Winning in a World of AI, Algorithms, and Tariffs.