More than half of all shoppers walked away from a brand last year because prices went up, according to our latest global shopper survey. But price tags aren’t the whole story. What really shapes loyalty is whether the product or service meets expectations. When the value feels off, even long-time customers won’t stick around.

Today, consumer brand loyalty needs to be earned every step of the way. And no, a rewards program alone won’t cut it. So what keeps customers coming back? What makes them feel good about sticking with you and what makes them walk away?

Our global shopper survey 2025 reveals what really drives customer retention and what retailers need to change to keep long-term loyalty alive.

What Makes Customers Walk Away?

54% of shoppers dropped a brand last year because of rising prices. That’s more than half your customer base, gone with a single cost update.

But it’s not just price hikes. Shoppers are also calling it quits over inconsistent product quality (46%) and poor customer experience (45%). If your brand loyalty marketing doesn’t focus on customer expectations across the board, loyalty won’t stick.

The takeaway? Brand loyalty and customer loyalty don’t survive on price tags alone. They’re built on trust, consistency and a shopping experience that actually delivers.

Global Loyalty: Same Price Tag, Different Expectations

One price doesn’t fit all, especially when you’re selling across regions. Our research shows just shows how likely customers in different regions are to drop a brand when prices rise:

- 60% of shoppers in France

- 57% in the UK

- 54% in Germany

- 52% in the US

- 46% in the Netherlands

So some audiences are more likely than others to end their loyalty when faced with higher costs. Even in the more tolerant markets, however, the margin is narrow.

Loyalty doesn’t scale on autopilot. What works in one market might flop in the next, unless your offers, messaging, and loyalty mechanics are built to flex.

Want the full regional breakdown? Check out the global shopper survey for more loyalty insights across five key markets.

Value-Driven Decisions: Loyalty Beyond the Price Tag

Not every shopper drops a brand over prices alone. Sometimes, it’s about trust – and whether a brand still reflects their values.

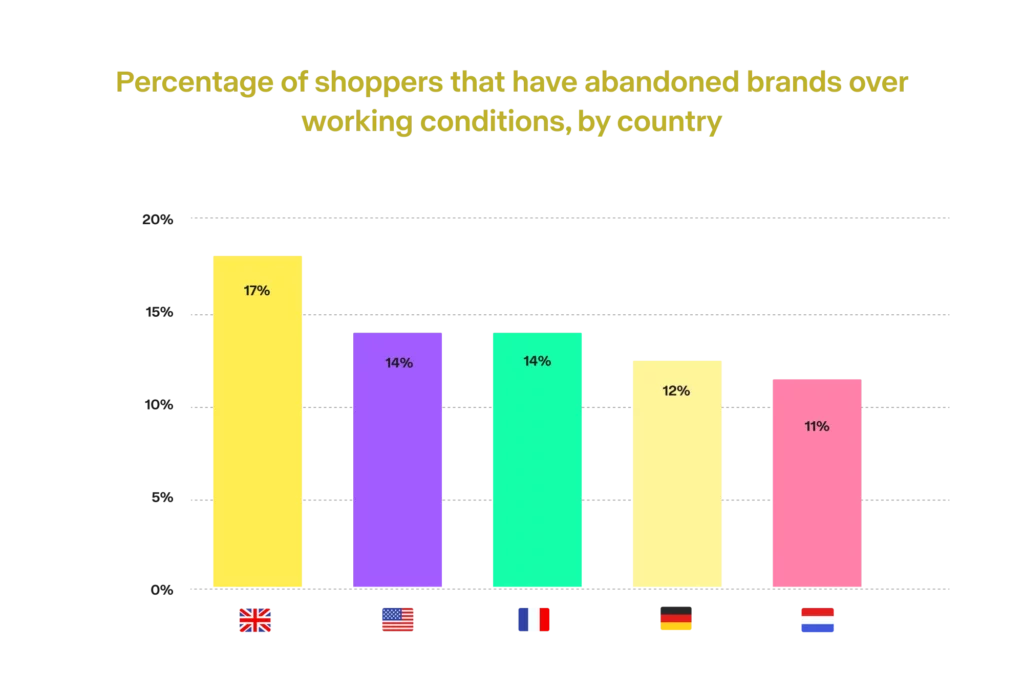

The global shopper survey shows that value-based decisions are becoming a real loyalty factor across markets:

- In the UK, 17% of shoppers would stop buying from a brand over poor working conditions, followed by 14% in the US and France, 12% in Germany, and 11% in the Netherlands

- In the UK, 13% of shoppers would stop buying over a brand’s geopolitical stance, compared with an average of 10% across other surveyed markets

- In the US, 18% of shoppers would stop buying over political affiliation, followed by 16% in the UK, 13% in Germany, 11% in France, and 10% in the Netherlands

These numbers are a clear signal that brand loyalty and customer loyalty are increasingly tied to ethical alignment and perceived integrity.

Retailers that want to increase brand loyalty need to go beyond offers and discounts. They need to stand for something and communicate that consistently.

Pre-Loved, Still Loyal: Second-Hand Is Part of the Strategy

In times of economic pressure, buying habits change and second-hand shopping is one of the clearest signs.

According to our research:

- 29% of UK shoppers turn to second-hand items

- 26% in France

- 24% in the Netherlands

- 20% in both the US and Germany

What used to be a niche behavior is now a mainstream response to rising prices. And it’s not just about saving money. For many, second-hand reflects smarter consumption, longer product life cycles, and stronger brand alignment.

Retailers that support this behavior with buy-back programs, pre-loved sections, or curated resale platforms are giving price-conscious customers a reason to stay loyal, even when they shop differently.

What Retailers Must Change Now

Retailers can’t afford to treat loyalty as an add-on. It needs to be a core part of your strategy, not just a points program running in the background.

To build and maintain brand loyalty, enterprise brands need to rethink how they deliver value. That means:

- Creating shopping experiences that feel smooth, personal, and consistent

- Giving customers control and flexibility across every touchpoint

- Standing for something and being vocal about it

- Using customer feedback and NPS scores to actually shape your offering

What This Means for Your Tech Setup

If loyalty looks different across markets, your platform needs to flex accordingly. For example, with:

- Regional promotion engines that adapt pricing and discounts per market

- Loyalty program modules that plug into your customer data – not run separately

- Dynamic content that adjusts based on values, behaviors, or lifecycle stage

- Real-time feedback integration (think net promoter score and customer satisfaction)

A tech stack that focuses on customer experience can help you meet these new expectations and adapt loyalty strategies across markets. With the right commerce platform, brands gain the flexibility to adjust pricing, programs, and content in line with what customers value most.

Consumer Brand Loyalty Costs, But Disloyalty Costs More

The numbers show just how quickly loyalty can disappear when expectations aren’t met. But they also show where the opportunity lies.

Retailers that align their values, experience and tech to what customers actually care about won’t just retain loyalty, but increase it. Because when shoppers feel understood, empowered and respected, they stick around.

Want the full picture? Download the global shopper survey and see what drives long-term loyalty in every region.