Key Takeaways

- Customer Lifetime Value measures total long-term revenue per customer and guides sustainable, profit-focused growth.

- CLV matters because retention costs less than acquisition, helping teams allocate marketing budgets more efficiently.

- Businesses calculate CLV using historical models for past performance or predictive models for future behavior and margins.

- Marketing, CRM, and product teams use CLV to target high-value customers, improve loyalty, and boost ROI.

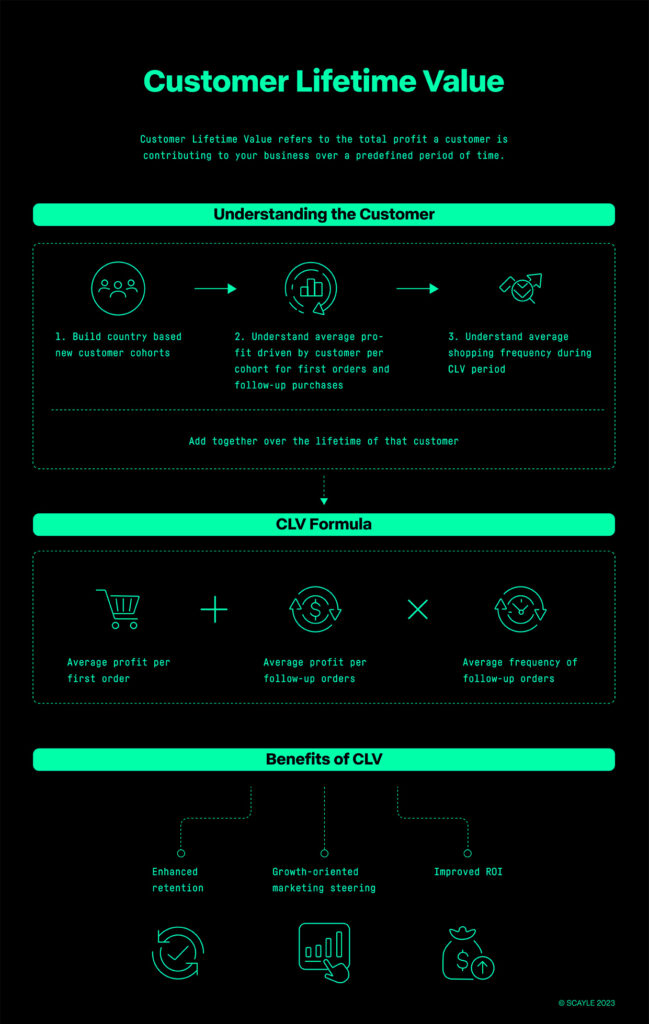

The goal of many businesses striving for sustainable growth is to increase the long-term value of their customers – in other words: increasing their Customer Lifetime Value (CLV). So what is CLV? It refers to the total amount of revenue the average customer is likely to spend with your business during a defined break-even time period with your company. It essentially tells you how valuable each customer is to your business and how much you can invest into their conversion.

Why is CLV marketing so important, you ask? It costs far more to convert a new customer than to keep an existing one. Therefore, you need to be able to allocate more investment to new customer-oriented measures and optimize their shopping frequency and retention rate via cost-efficient CRM measures.

Why should your business measure CLV? How is CLV calculated? What are the uses of CLV in practice? In this article, we’ll introduce you to the importance of monitoring Customer Lifetime Value.

Why Should Your Business Measure CLV?

By monitoring and improving your customer lifetime value, you’re allowing your business to grow at a faster pace and focus your budgets to generate long-term value. What are the main benefits of focusing on CLV?

1. Improve your customer retention measures

By tracking how much the average customer spends with your business, you can monitor how well your company is retaining customers and what marketing tactics are useful for increasing their loyalty, and how your retention strategies perform.

2. Establish a growth-oriented marketing mix

Understanding your customer lifetime value and considering your marketing channel’s new customer share helps you to create a cost-efficient but growth-oriented marketing mix. Instead of targeting the same lower-funnel users over and over again, you can optimize your investments towards growing your customer base at a cost ratio in line with your customer break-even expectations.

3. Improve your marketing ROI

Defining clear marketing steering objectives for the acquisition of new customers and the retention of existing customers helps you to improve your marketing ROI on channel, campaign, and adgroup level in line with your strategic long-term goals in the day-to-day channel optimization.

Explore new ways to boost your ROI by increasing your CLV in our guide, Marketing ROI: How to Increase Your Profit Return by Five.

How can the CLV be calculated?

While 76% of companies say CLV is an important metric for their organization, only 42% feel equipped to measure it correctly. How do you calculate CLV?

Historical CLV

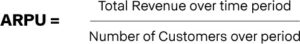

The first method makes use of a historical CLV – a way of measuring CLV based on your past performance. The most popular historical method is determining your average revenue per user (ARPU).

When selecting the time period to look at, it makes sense to use a minimum time frame of 12 months to include the full seasonality pattern of 1 year in your data. You should also consider if there have been major changes in your business during that period that need to be considered when interpreting the results.

If possible, you should look at a period of 24-36 months. Using a longer period helps you to reduce the error of any shocks or booms in your business. Then, simply APRU = CLV.

But what about customer profitability? A historical CLV calculation method is simple, easy to understand and replicate. However, historical CLV assumes your customers – and their tastes, income, happiness, level of demand, and behaviors – will remain constant.

The same applies to margin-impacting factors, such as discount levels, return rates, or logistic costs as well as seasonal impact, e.g., higher fashion margins in winter than in summer. We know these factors to be in flux. Therefore, this method can’t give any real indication of the future.

Predictive CLV

Predictive CLV, on the other hand, models the future behavior of consumers and predicts the margin evolution of your business to provide a projection for CLV using predictive algorithms. As this method takes into account possible future changes to customer behavior and margins, it can better forecast changes to your customer lifetime value.

This model is “predictive” as the assumptions and metrics used in the formula are based on current or projected data. A business projection helps to consider the profitability outlook of the predicted month. These four metrics combine to give a business a snapshot of an average customer’s transactional behavior.

More complex predictive CLV models may aim to model customers’ behavior based on external factors and/or the business cycle. In general, predictive CLV is thought to be more accurate – however, the accuracy will entirely depend on the predictions and assumptions made in the model.

CLV in Action: Usage of Measuring CLV

CLV has many applications – and businesses are using this versatile metric to introduce important efficiency gains. Ultimately, a higher CLV signifies more profitable customers.

The effectiveness of marketing campaigns is driven by increasing ROI. CLV can be used as a tool to steer decisions to attract more valuable customers and focus a higher share of your marketing investment to acquire new customers instead of reaching out to existing clients over expensive marketing channels. Without monitoring your CLV over time, marketing teams may undervalue retention strategies such as automated reactivation mailings, promotional codes, and loyalty programs needed to efficiently grow the value of your existing customer base. “Evaluating the effect of a marketing channel considering its new customer share and relating the customer acquisition cost to the average CLV helps marketers to understand if they are acquiring the right audience at an affordable price for their business,” stresses our expert, Miriam Hollerbach, Head of Marketing Consulting at SCAYLE.

CLV-based segmentation of customers and the analysis of their onsite and shopping behavior can also help product development teams determine how to enhance the customer experience and help your buying teams to optimize the assortment. By understanding which customers are most profitable for your business, you have the possibility to gain a deeper insight into their pain points and needs.

Conclusion: Mastering Customer Lifetime Value

Monitoring your CLV is your golden ticket to improving marketing ROI, improving customer engagements and targeting sustainable growth. As Miriam explains: “Knowing your company’s CLV allows you to understand the limits of your marketing investment and helps you to make more informed decisions about where best to allocate your spends to have the greatest impact on long-term profitability and business growth.”

By analyzing which marketing strategies best suit your customers, you can get rid of expensive marketing channels and learn more about your valuable customer’s preferences.

However, consumer tastes are changing rapidly – and it’s important to keep constantly adjusting your measuring metrics. Want to learn more about the topic? Check out our white paper on boosting your marketing ROI.